In the last several posts I analyzed the historical behavior of the number of jobs in Rhode Island, payroll employment, and the number of Rhode Island residents who are employed, resident employment. As I noted, there are significant differences between these two data series, especially since they are obtained from two separate labor market surveys.

In this post, I will provide only one chart, but that chart will allow you to understand very readily why Rhode Island's unemployment is so high and why it hasn't been falling as one would expect during a recovery. Of course, as I was writing that last sentence, I realized that there is a distinct possibility that Rhode Island is no longer in a recovery, which I discussed in the last two posts. For now, I still haven't concluded that Rhode Island has actually entered a double-dip recession, so as far as I can tell, Rhode Island is clinging to its two-year old recovery by its finger nails. I guess this makes it fortunate that we didn't raise the sales tax on finger nail establishment services last year!

I want to focus on the employment rate for Rhode Island: the ratio of resident employment to the resident working-age population. Both of these series are derived from the household survey. Ideally, this ratio should rise during recoveries, as the number of employed residents rises as a proportion of the working-age population, and fall during recessions, as employed residents become a smaller proportion of the population. But this is Rhode Island -- we don't do things like everyone else!

The chart below shows the historical behavior of the employment rate for Rhode Island since January of 2000 (click to enlarge).

When Rhode Island's payroll employment peaked all the way back in December of 2006 (a full year before the US peak), our state's employment rate reached its maximum at just below 66 percent (0.66 in the chart). It has literally been all downhill since then.

Clearly, the serious recession we experienced brought about continuous large reductions in the proportion of our state's population that is employed. However, consistent with the charts from the previous two posts, Rhode Island's employment rate has been declining throughout this entire recovery! At the end of the last recession, around late 2009 into very early 2010, the employment rate actually recovered a bit, moving back to 60 percent. Ironically, since our current (?) recovery began in February of 2010, we have seen a clear downtrend in this ratio.

The inevitable consequence of the fact that an ever-smaller proportion of Rhode Island's population remains employed (our declining employment rate) has been a high unemployment rate that seems incapable of falling below 11 percent over any prolonged period of time.

There are several ironic elements in all of this. Recall that resident employment is not restricted to jobs in Rhode Island. It includes Rhode Island residents who work either in Rhode Island or in other places. That is significant at the present time since Massachusetts is doing so much better than Rhode Island is, as its jobless rate is one we can only fantasize about here. Also, resident employment includes self-employed persons, an element that often escapes from the other labor market survey. Positive out-of-state and self-employment should have been able to at least moderate if not reverse our declining employment rate by this point. Yet it hasn't.

To conclude, let me briefly cite the math that underlies a declining ratio. The fact that the employment rate, the ratio of resident employment to our working-age population, is falling through time means that in percentage terms, resident employment has been falling relative to our state's working-age population. It doesn't take much to figure out that this has played a central element in our state's high unemployment rate.

A blog devoted to providing my perspectives on the Rhode Island economy that utilizes discussion, tables, graphs, and hyperlinks to illustrate key points and where I come a lot closer to saying what I really think than what I say to the general media. A DISCLAIMER: Everything in and on this Blog is solely attributable to me and bears no connection whatever to either the University of Rhode Island overall or the URI economics department.

Friday, March 23, 2012

Monday, March 19, 2012

Just When You Thought Things Here Couldn't Get Worse!!

In the prior few posts, I outlined how badly Rhode Island's payroll employment has been performing of late. In fact, in the last post I raised the possibility that Rhode Island might actually have entered a double-dip recession. While this is a distinct possibility, I am not necessarily willing to embrace that conclusion -- yet. In this post, I will show the recent behavior of the "other" kind of employment: resident employment.

What makes life interesting for persons like myself who follow Rhode Island's economy is that the two employment series are derived from different surveys.

Payroll employment comes from the Current Employment Survey (CES) for the near-term results, which are estimates of the far-more inclusive Establishment Survey. Synchronizing the results of these two surveys, which occurs with the new January data each year, is called rebenchmarking. Think of payroll employment as the number of jobs in Rhode Island, as these data are derived from surveys of employers in this state.

Resident employment is obtained from the Household Survey, which as its name implies, is a survey of Rhode Island residents obtained from individual households in this state. Values of this series too are often revised along with the new January data each year.

There are several critical differences between these data series. First, resident employment includes the number of employed Rhode Island residents, no matter where they work, whether in Rhode Island or in other places. In addition to this, resident employment includes self-employed individuals, a very critical factor to track when the state of Rhode Island's economy is changing. These two factors are capable of causing large and significant divergences between payroll and resident employment.

You saw the recent behavior of payroll employment in the prior posts. It has deteriorated during the last six months. What about the behavior of resident employment? The chart below (click to enlarge) shows Resident Employment for Rhode Island since 2009.

There are several amazing features of this chart. First, note that when the current recovery for Rhode Island began in June of 2010, resident employment was actually falling! The level of "support" for resident employment here is just above 500,000. Support held until June of 2011, when resident employment dropped below 500k. What had been support then became "resistance." Resident employment recently made a run at the new resistance line of 500k, but that attempt failed. It has now been declining for the past few months. One thing should be clear from this chat, however: resident employment in Rhode Island has been on a very well-defined downtrend throughout this entire recovery. Now that's very strange! I have always noted how idiosyncratic Rhode Island's economy is, but this is a new one even for me. Wait, though, a further look at the data in this chart produces a truly amazing graph: year-over-year changes in resident employment:

This would be a very strong chart if we were to turn it upside down. Unfortunately it has the correct orientation. The bright moments for Rhode Island, then, the relatively small number of green bars that indicate year-over-year increases, occurred during the May through November of 2010 period. I guess it is safe to say that for Rhode Island: "Those were the "good old days."

What this rather scary chart reveals is that the factor dominating changes in the household survey for a number of years now has been Rhode Island's declining population. Remember, our state's population has been shrinking consistently since July of 2004 -- yet another dubious distinction for Rhode Island. The pace of economic activity here has helped at times, as have job prospects for our residents in Connecticut and Massachusetts. However, I have to conclude that what this chart really illustrates is the set of major structural negatives and problems facing Rhode Island. At present, are we really the "masters of our own fate?" Even if we are, there are serious questions about how much longer that status would remain intact.

What makes life interesting for persons like myself who follow Rhode Island's economy is that the two employment series are derived from different surveys.

Payroll employment comes from the Current Employment Survey (CES) for the near-term results, which are estimates of the far-more inclusive Establishment Survey. Synchronizing the results of these two surveys, which occurs with the new January data each year, is called rebenchmarking. Think of payroll employment as the number of jobs in Rhode Island, as these data are derived from surveys of employers in this state.

Resident employment is obtained from the Household Survey, which as its name implies, is a survey of Rhode Island residents obtained from individual households in this state. Values of this series too are often revised along with the new January data each year.

There are several critical differences between these data series. First, resident employment includes the number of employed Rhode Island residents, no matter where they work, whether in Rhode Island or in other places. In addition to this, resident employment includes self-employed individuals, a very critical factor to track when the state of Rhode Island's economy is changing. These two factors are capable of causing large and significant divergences between payroll and resident employment.

You saw the recent behavior of payroll employment in the prior posts. It has deteriorated during the last six months. What about the behavior of resident employment? The chart below (click to enlarge) shows Resident Employment for Rhode Island since 2009.

There are several amazing features of this chart. First, note that when the current recovery for Rhode Island began in June of 2010, resident employment was actually falling! The level of "support" for resident employment here is just above 500,000. Support held until June of 2011, when resident employment dropped below 500k. What had been support then became "resistance." Resident employment recently made a run at the new resistance line of 500k, but that attempt failed. It has now been declining for the past few months. One thing should be clear from this chat, however: resident employment in Rhode Island has been on a very well-defined downtrend throughout this entire recovery. Now that's very strange! I have always noted how idiosyncratic Rhode Island's economy is, but this is a new one even for me. Wait, though, a further look at the data in this chart produces a truly amazing graph: year-over-year changes in resident employment:

This would be a very strong chart if we were to turn it upside down. Unfortunately it has the correct orientation. The bright moments for Rhode Island, then, the relatively small number of green bars that indicate year-over-year increases, occurred during the May through November of 2010 period. I guess it is safe to say that for Rhode Island: "Those were the "good old days."

What this rather scary chart reveals is that the factor dominating changes in the household survey for a number of years now has been Rhode Island's declining population. Remember, our state's population has been shrinking consistently since July of 2004 -- yet another dubious distinction for Rhode Island. The pace of economic activity here has helped at times, as have job prospects for our residents in Connecticut and Massachusetts. However, I have to conclude that what this chart really illustrates is the set of major structural negatives and problems facing Rhode Island. At present, are we really the "masters of our own fate?" Even if we are, there are serious questions about how much longer that status would remain intact.

Thursday, March 15, 2012

Has Rhode Island Entered Into A Double-Dip Recession?

I have made several posts recently that deal with the rebenchmarked payroll employment data from a fairly long-term perspective. In this post, I will provide you with two charts that illustrate the shorter-term behavior of payroll employment for Rhode Island. These charts are very disturbing, illustrating that on a year-over-year basis (i.e., comparing a given month with the same month one year earlier), payroll employment here has either been declining or flat for six consecutive months. Is this the beginning of a recession? More about this below.

The first chart (click to enlarge), contains an alarming element: the magnitudes of the payroll employment declines have been worsening for the most recent two months of data, in spite of the fact that national economic activity has been improving.

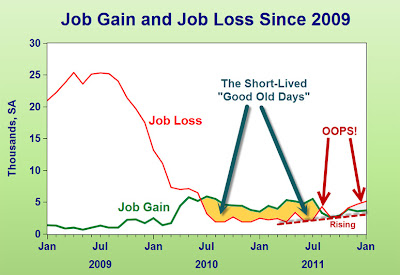

The second chart (click to enlarge) shows the underlying basis of the chart above: job gains and job loss since 2009.

Note that the monthly employment change is the difference between job gain and job loss for each month, in spite of how this is reported by our local media. I find it very striking to see how much job loss here has declined since 2009. Sadly, job gain hasn't done much since the first part of 2010. And, over the past year, job loss appears to be accelerating at the same time that job gains are dissipating.

To some, the information in these charts might be enough to make a recession call -- that Rhode Island had indeed entered into the second "dip" of a double dip recession. I am not quite ready to make that call just yet. A recession or recovery call should be predicated on the behavior of a broadly based set of economic indicators, not just a single indicator, even one as important as payroll employment. This, of course, is what my Current Conditions Index (CCI) was designed to do. Based on the behavior of the CCI, I have to conclude that it is premature to say that Rhode Island has entered into a recession at this time. But it is safe to say that Rhode Island's economy is hanging on by its finger nails!

For anyone who thinks that the austerity engaged in by Rhode Island's cities and towns has not had a negative impact on Rhode Island's economy, guess again. It is one of the more critical elements of Rhode Island's most recent malaise. Of course, let's not forget the fact that Rhode Island's tax and cost structure continues to be highly non-competitive, driven in large part by the lack of skills of our state's labor force (for those who decide to stay in-state, at least). Apparently those two elements have been more than sufficient to offset the beneficial effects of the improving national economy on the economy of Rhode Island. Sadly, austerity here will continue, as will the non-competitiveness of our state's tax and cost structure. Has Rhode Island become immune to national growth for the next few years? I sure hope not. But we'll have to wait and see.

Next Post: How is resident employment, the "other" employment measure for Rhode Island, performing? Surely, it can't be doing as badly as payroll employment, can it? Or can it?

The first chart (click to enlarge), contains an alarming element: the magnitudes of the payroll employment declines have been worsening for the most recent two months of data, in spite of the fact that national economic activity has been improving.

The second chart (click to enlarge) shows the underlying basis of the chart above: job gains and job loss since 2009.

Note that the monthly employment change is the difference between job gain and job loss for each month, in spite of how this is reported by our local media. I find it very striking to see how much job loss here has declined since 2009. Sadly, job gain hasn't done much since the first part of 2010. And, over the past year, job loss appears to be accelerating at the same time that job gains are dissipating.

To some, the information in these charts might be enough to make a recession call -- that Rhode Island had indeed entered into the second "dip" of a double dip recession. I am not quite ready to make that call just yet. A recession or recovery call should be predicated on the behavior of a broadly based set of economic indicators, not just a single indicator, even one as important as payroll employment. This, of course, is what my Current Conditions Index (CCI) was designed to do. Based on the behavior of the CCI, I have to conclude that it is premature to say that Rhode Island has entered into a recession at this time. But it is safe to say that Rhode Island's economy is hanging on by its finger nails!

For anyone who thinks that the austerity engaged in by Rhode Island's cities and towns has not had a negative impact on Rhode Island's economy, guess again. It is one of the more critical elements of Rhode Island's most recent malaise. Of course, let's not forget the fact that Rhode Island's tax and cost structure continues to be highly non-competitive, driven in large part by the lack of skills of our state's labor force (for those who decide to stay in-state, at least). Apparently those two elements have been more than sufficient to offset the beneficial effects of the improving national economy on the economy of Rhode Island. Sadly, austerity here will continue, as will the non-competitiveness of our state's tax and cost structure. Has Rhode Island become immune to national growth for the next few years? I sure hope not. But we'll have to wait and see.

Next Post: How is resident employment, the "other" employment measure for Rhode Island, performing? Surely, it can't be doing as badly as payroll employment, can it? Or can it?

Tuesday, March 13, 2012

Current Conditions Index: January 2012

This post is an abbreviated version of my Current Conditions Index report for January of 2012 (it omits the indicator table and "The Bottom Line." For the full report, as well as PDF files with past reports, you can visit my web site: http://www.llardaro.com . This report was covered fairly well by the local media. As always, the Providence Business News did a very nice job of discussing the report, as did GoLocalProv.com. The ProJo also had its usual couple of paragraphs (only). The message from this report: as the national economy accelerates, Rhode Island is being left behind. The prior three posts provide you with much additional detail.

Rhode Island begins 2012 equipped with its newly revised labor market data. The prior data had painted a rather grim picture with Rhode Island’s economy being essentially “dead in the water” for much of the second half of 2011. I had hoped the new data would show that things here were materially better than what we had been led to believe, especially concerning the abysmal performances of our Labor Force, Unemployment Rate, and the two employment series, Resident and Payroll Employment. I wasn’t sadly disappointed by the revised data. More to the point, I was alarmed by how much worse the actual performances of every one of those data series were. To summarize this very succinctly: the “good stuff” (the Labor Force, and both kinds of employment) was revised sharply lower while the “bad stuff” (the Unemployment Rate) was revised significantly higher. In light of these new data, we need to rethink much of what we had thought about our state’s labor market performance. Check my Blog in the coming weeks for charts and posts about this.

Rhode Island begins 2012 equipped with its newly revised labor market data. The prior data had painted a rather grim picture with Rhode Island’s economy being essentially “dead in the water” for much of the second half of 2011. I had hoped the new data would show that things here were materially better than what we had been led to believe, especially concerning the abysmal performances of our Labor Force, Unemployment Rate, and the two employment series, Resident and Payroll Employment. I wasn’t sadly disappointed by the revised data. More to the point, I was alarmed by how much worse the actual performances of every one of those data series were. To summarize this very succinctly: the “good stuff” (the Labor Force, and both kinds of employment) was revised sharply lower while the “bad stuff” (the Unemployment Rate) was revised significantly higher. In light of these new data, we need to rethink much of what we had thought about our state’s labor market performance. Check my Blog in the coming weeks for charts and posts about this.

This does not necessarily mean that the overall picture of Rhode Island’s economic performance in 2011 needs to be entirely overturned, though. The assessment of overall performance must be based on a broadly based set of indicators, which is precisely what the Current Conditions Index was designed to do. For 2011, three monthly values were revised lower (January, November, and December), while one (March) increased. Based on these changes, Rhode Island’s economy was a bit more “dead in the water” than I had earlier thought. In spite of this, our exceedingly tepid recovery did continue, albeit barely since the second half of 2011. Our bright spots, most notably Retail Sales, remained. It was our sore points that turned out to be quite a bit more sore. Sadly, or happily, depending on your preference, they still failed to improve, but by wider margins.

Let’s begin indicator discussion with the bright spots. For January, the Current Conditions Index registered a value of 58, as seven of the twelve indicators improved. January’s CCI reading exceeded that from a year earlier, breaking a string of 10 consecutive misses. Rhode Island’s recovery is now 23 months old.

Retail Sales improved for the fifth consecutive month (+3.5%), starting off 2012 on a very positive note. US Consumer Sentiment rose in January (1.2%), breaking a string of seven consecutive declines. Rhode Island’s manufacturing sector showed significant strength, with Total Manufacturing Hours surging by 7.3 percent, based on greater employment and a sharply longer workweek, both of which helped to give some credibility to the dramatic increase of 19 percent in the Manufacturing Wage. Benefit Exhaustions, a measure of long-term unemployment, fell again, by 10.7 percent. At the other end of the jobless spectrum, New Claims, a leading labor market indicator that includes layoffs, rose sharply, by 8.2 percent. Sadly, its uptrend appears to remain intact. Single-Unit Permits, which tracks new home construction, the most volatile of the CCI indicators, surged by 67.4 percent in January, obviously affected by weather.

Our Labor Force continued its more-horrible-than-we-knew performance in January (-0.9%), and with this the decline in our Unemployment Rate was not welcome news. Employment Service Jobs, a leading labor market indicator that includes “temps,” fell for a tenth time. Finally, Private Service-Producing Employment declined again (its levels were revised lower) as did Government Employment.

Sunday, March 11, 2012

Dates That Will Live in Infamy?

In the previous post, I showed the rebenchmarked payroll employment data since 2009. In order to show how dire things have now become in Rhode Island, I am including a graph of payroll employment going back to 1990, with specific dates of turning points highlighted (click to enlarge).

I hope that those who have been around Rhode Island for a while will be able to put events with the dates of turning points. What I find very striking, however, is how the current employment drop is not unlike that in 1990 and 1991, as the banking crisis unfolded. Clearly, the percentage differences are not the same today and they were during the 1990-91 period, but we had something going for us in 1990-91 that we don't today: back then, we were barely past the transformation to a post-manufacturing economy (that occurred in Q3 of 1987). In other words, we had a margin for error that has long since disappeared.

The final question: Will Rhode Island make a run like it did in the early 1990s until the peak in December of 2000? Back then, our state's goods-producing sector was much larger than it has become today, and along with that decline we have lost the large goods-producing multipliers and their ability to get recoveries going rather briskly. Recall also, there was a rather sizable tech boom in the 1990s, the likes of which we might not see until battery technology is truly advanced, or some other advances we are not yet aware of emerge into positions of prominence.

Do I think Rhode Island will now make a major move up in its payroll employment during the next few years? Sadly, my answer is an emphatic NO! We have lost the margin for error a manufacturing-based economy once afforded us and the way this state is run is not conducive to the requirement of highly proactive government in the post-manufacturing era. Add to this that overhead, primarily pension obligations, dominates virtually all decision making here, and the primary question is whether Rhode Island's payroll employment will be able to sustain itself above the recent trough, and its levels in May of 1998 and April of 1990.

I hope that those who have been around Rhode Island for a while will be able to put events with the dates of turning points. What I find very striking, however, is how the current employment drop is not unlike that in 1990 and 1991, as the banking crisis unfolded. Clearly, the percentage differences are not the same today and they were during the 1990-91 period, but we had something going for us in 1990-91 that we don't today: back then, we were barely past the transformation to a post-manufacturing economy (that occurred in Q3 of 1987). In other words, we had a margin for error that has long since disappeared.

The final question: Will Rhode Island make a run like it did in the early 1990s until the peak in December of 2000? Back then, our state's goods-producing sector was much larger than it has become today, and along with that decline we have lost the large goods-producing multipliers and their ability to get recoveries going rather briskly. Recall also, there was a rather sizable tech boom in the 1990s, the likes of which we might not see until battery technology is truly advanced, or some other advances we are not yet aware of emerge into positions of prominence.

Do I think Rhode Island will now make a major move up in its payroll employment during the next few years? Sadly, my answer is an emphatic NO! We have lost the margin for error a manufacturing-based economy once afforded us and the way this state is run is not conducive to the requirement of highly proactive government in the post-manufacturing era. Add to this that overhead, primarily pension obligations, dominates virtually all decision making here, and the primary question is whether Rhode Island's payroll employment will be able to sustain itself above the recent trough, and its levels in May of 1998 and April of 1990.

Saturday, March 10, 2012

Rebenchmarked Payroll Employment: We're Falling!!!

The recently rebenchmarked labor market data for Rhode paint a very dismal picture. Not only was payroll employment here less than had been thought through much of 2011, it has actually been falling for the last several months. Worse yet, not only has payroll employment been declining, it has now fallen all the way to within 700 jobs of its low since before the last recession!

Normally, I would say that a picture is worth a thousand words. In this case, it is more appropriate to rephrase this to say a thousand tears. Look very carefully at the chart below of payroll employment since 2009 (click to enlarge).

So, as the US economy and most notably national payroll employment continues to accelerate, Rhode Island finds itself not only with declining employment, but it has experienced a series of monthly declines that have moved payroll employment to just slightly above the trough it attained in July of 2009, and all the way back to its level in May of 1998! All that remains between Rhode Island's January 2012 employment level and its recent trough is 700 jobs. So, as of January, 2012, Rhode Island's payroll employment remains 7.8 percent below its prior peak.

As I finish this post, let me reiterate a statistic that I have cited here on numerous occasions: payroll employment in Rhode Island peaked in December of 2006, a full year before the US employment peak. Happy 5th anniversary, Rhode Island!

Normally, I would say that a picture is worth a thousand words. In this case, it is more appropriate to rephrase this to say a thousand tears. Look very carefully at the chart below of payroll employment since 2009 (click to enlarge).

So, as the US economy and most notably national payroll employment continues to accelerate, Rhode Island finds itself not only with declining employment, but it has experienced a series of monthly declines that have moved payroll employment to just slightly above the trough it attained in July of 2009, and all the way back to its level in May of 1998! All that remains between Rhode Island's January 2012 employment level and its recent trough is 700 jobs. So, as of January, 2012, Rhode Island's payroll employment remains 7.8 percent below its prior peak.

As I finish this post, let me reiterate a statistic that I have cited here on numerous occasions: payroll employment in Rhode Island peaked in December of 2006, a full year before the US employment peak. Happy 5th anniversary, Rhode Island!

Monday, March 5, 2012

Rhode Island's Real GDP for 2010

We recently received the state real GDP data for the year 2010. The results, at first glance, seem encouraging: RI's 2010 growth rate was 2.8 percent, fourth in New England for that year. For the New England states, growth rates ranged from a low of 1.3% in New Hampshire to a high of 4.2% in Massachusetts. Should RI cheer about this? Are things at long last turning around here?

Before going much farther, let me reiterate my long-held view that state real GDP is quite possibly THE least accurate and most noisy statistic at the state level. But in spite of this, it is the primary "game in town." So, let's analyze the data for what it is (and isn't).

While it is very tempting to focus exclusively on the most recent data point here (the year 2010), that would be very misleading (literally short sighted), since where we are today is a function of past levels of state real GDP along with the rates of growth or decline we experienced in recent years. The problem for Rhode Island is those past rates of growth -- actually decline during "The Great Recession."

Using actual values, Rhode Island was the only New England state to experience declining real GDP in 2007 (a fall of 1%), as its recession began in June of 2007 based on my Current Conditions Index. It then went on to record rather substantial declines over the next two years, 2% in 2008 and 1.8% in 2009. Remember: continuous declines exert cumulative effects on a state's economy. And, this makes it more difficult to return to where things were before the series of declines began.

In order to take the past directly into account and make it easier to visualize what happened over the entire 2007 - 2010 period (this is what the most recent data release focused on), I have expressed actual values relative to their values in 2007. So, the value for any state in a given year indicates that value as a percentage of that state's 2007 value. A chart of this, which includes a data table, is given below (click to enlarge):

Do I need to say which line represents Rhode Island? The red dotted line "bringing up the bottom" over the entire period is Rhode Island. Compared to the US overall, New England overall, and the six New England states individually, Rhode Island fell the farthest and has rebounded the least. Note that several of the New England states had returned to or exceeded their 2007 real GDP values by 2010, most notably Massachusetts (102.4%), Vermont (101.2%), and Connecticut (100.5%). New Hampshire and Maine were almost back to 2007 levels, with 99.5% and 99.2% levels, respectively. For Rhode Island, we have only managed to return back to 98.9%.

Make no mistake about it, there is no cause for celebration in these numbers. Contrast the unemployment rates of the other New England states with that of Rhode Island, and it is instantly apparent that Rhode Island's labor market is farther away from where it was and wants to be than anywhere else in New England. We don't fare much better for employment as well. Payroll employment in Rhode Island peaked well before either the US or any other New England state and it remains at very depressed levels to this day!

For all of the apologists who will view this and dismiss it based on the convenient label "being negative," let me offer another saying for Rhode Island they can use in their constant search for mediocrity: "Almost doesn't count except in horseshoes, bombing raids, and for the Rhode Island economy." Those far less neanderthal intellectually will instantly appreciate the fact that the only question that matters is whether this is analysis is accurate. If it is, and it is negative, then it would appear to be an appropriate time for our leaders to institute changes that make things better here. It's not as if we haven't had the opportunities to do this, especially during the global meltdown. As the saying goes, "A crisis is a terrible thing to waste." We wasted that crisis, a time that was perfect for Rhode Island to reinvent itself and to make it more competitive so it too could be benefiting from the recent upsurge in national growth. We can't change the past, but we can meaningfully alter the future. We appear to be running out of time to make things significantly better here. Now would be a good time for the efforts to begin!

Before going much farther, let me reiterate my long-held view that state real GDP is quite possibly THE least accurate and most noisy statistic at the state level. But in spite of this, it is the primary "game in town." So, let's analyze the data for what it is (and isn't).

While it is very tempting to focus exclusively on the most recent data point here (the year 2010), that would be very misleading (literally short sighted), since where we are today is a function of past levels of state real GDP along with the rates of growth or decline we experienced in recent years. The problem for Rhode Island is those past rates of growth -- actually decline during "The Great Recession."

Using actual values, Rhode Island was the only New England state to experience declining real GDP in 2007 (a fall of 1%), as its recession began in June of 2007 based on my Current Conditions Index. It then went on to record rather substantial declines over the next two years, 2% in 2008 and 1.8% in 2009. Remember: continuous declines exert cumulative effects on a state's economy. And, this makes it more difficult to return to where things were before the series of declines began.

In order to take the past directly into account and make it easier to visualize what happened over the entire 2007 - 2010 period (this is what the most recent data release focused on), I have expressed actual values relative to their values in 2007. So, the value for any state in a given year indicates that value as a percentage of that state's 2007 value. A chart of this, which includes a data table, is given below (click to enlarge):

Do I need to say which line represents Rhode Island? The red dotted line "bringing up the bottom" over the entire period is Rhode Island. Compared to the US overall, New England overall, and the six New England states individually, Rhode Island fell the farthest and has rebounded the least. Note that several of the New England states had returned to or exceeded their 2007 real GDP values by 2010, most notably Massachusetts (102.4%), Vermont (101.2%), and Connecticut (100.5%). New Hampshire and Maine were almost back to 2007 levels, with 99.5% and 99.2% levels, respectively. For Rhode Island, we have only managed to return back to 98.9%.

Make no mistake about it, there is no cause for celebration in these numbers. Contrast the unemployment rates of the other New England states with that of Rhode Island, and it is instantly apparent that Rhode Island's labor market is farther away from where it was and wants to be than anywhere else in New England. We don't fare much better for employment as well. Payroll employment in Rhode Island peaked well before either the US or any other New England state and it remains at very depressed levels to this day!

For all of the apologists who will view this and dismiss it based on the convenient label "being negative," let me offer another saying for Rhode Island they can use in their constant search for mediocrity: "Almost doesn't count except in horseshoes, bombing raids, and for the Rhode Island economy." Those far less neanderthal intellectually will instantly appreciate the fact that the only question that matters is whether this is analysis is accurate. If it is, and it is negative, then it would appear to be an appropriate time for our leaders to institute changes that make things better here. It's not as if we haven't had the opportunities to do this, especially during the global meltdown. As the saying goes, "A crisis is a terrible thing to waste." We wasted that crisis, a time that was perfect for Rhode Island to reinvent itself and to make it more competitive so it too could be benefiting from the recent upsurge in national growth. We can't change the past, but we can meaningfully alter the future. We appear to be running out of time to make things significantly better here. Now would be a good time for the efforts to begin!

Subscribe to:

Posts (Atom)