Now that the US recession has officially been declared as being over, the most obvious and pressing question is where we go from here?

As there are confusions about what a recession or recovery actually means (see the previous post), there are just as many confusions concerning whether we are actually in a recovery or a recession. I have provided a chart that will help to illustrate this point (click the chart to enlarge it).

I think it is safe to say that generally, most people refuse to believe the pronouncements of economists concerning when an economy is in the very early stages of either recession or recovery. Consider early recession in the chart. Note that the economy is not very far from its peak in economic activity. So, when economic data are released, the numbers are still very good in a historical context. In fact, unless you focus on what economists refer to as leading economic indicators, the numbers will show an economy that is still climbing the activity "hill" (i.e., to the left of the peak), making it even more difficult to assess what is actually taking place. Perhaps the best example of this is the one measure the general population focuses on most -- the unemployment rate. This is a lagging indicator, meaning its level at present reflects what happened in months past. Remember: a recession is NOT defined as a level of diminished economic activity. As the National Bureau of Economic Research (the "dating" body for economic cycles) points out, it is instead a period of diminishing activity. This highlights the distinction between levels and rates of change that I discussed in the previous post.

Right now, nationally at least, we find ourselves in the early stages of a recovery. Once again, look at the chart above. In the early stages of a recovery, an economy is close to the "bottom" of economic activity. The numbers that are released are therefore not going to be very good, and after a recession period, often discouraging. Of course, if you focus on lagging indicators, you will almost certainly conclude that we are still in a recession.

At this point, I need to reiterate that contrary to popular "wisdom," being in a recovery does not necessarily require a return to "normal" times and historical averages (or above) of economic variables. It might. But generally it takes some time to get back to "typical" levels. The next chart will help to explain this.

As this chart should illustrate, not all recoveries are alike. Each path reflects how rapidly economic activity will be rising in the future. Historically, when there is a very deep national recession like the one we just had, the economy rebounds quickly. This leads to a "V" shaped recovery (the green line). It doesn't take all that long to return to "normal" levels of economic activity. In that situation, a recovery feels like a recovery.

But recovery paths are different since not all recessions are the same. Global recessions occur over longer periods and are generally more damaging than more "typical" recessions. When there is a global recession with major financial problems, as the one we just had, the pace of recovery tends to be slow and it takes a longer time to return to "normal" levels of economic activity (the red line). Consider that at present, individuals are spending less, saving, and paying down debt. Banks have lowered leverage. All of this is very positive in the medium to longer term, but it extracts a cost on the rate of economic growth in the short term. Add to this the fact that banks aren't lending as much as they might have in previous recoveries, and you get what Mohammed El-Erian of Pimco refers to as "The New Normal" (click here for a video of El-Erian explaining this concept). He and I are somewhat concerned with the possibility of deflation in the near-term as well.

So, where does all of this leave us? What are you to think? Hopefully you are now more aware of the basics of what is really going on, what an early recovery means, and the possible paths the US economy might take. THE question is which path will be the one our economy follows. Let me be very honest about this: economists, including me, don't really know the answer to this, in spite of all our forecasts and predictions. In this context, let me state one of my favorite sayings: CERTAINTY IS AN ILLUSION. Any forecast, no matter who makes it, is essentially a scenario. It assumes what the areas are that will be the most important over the forecast period, how each of those areas will actually change, and the interactions between and among them. Obviously, there are numerous sources of potential error.

In a period of such uncertainty, where things seldom appear to be what they actually are, many persons are all too willing to step forward with their "solutions." While these might sound good, or appeal to the increasingly subjective notion of "common sense," they too are based on scenarios. So, they might be right. Or, they might be wrong. Let me recommend that you critique any or all of these within the context of one of my favorite sayings: "Complex problems have simple, easy to understand, wrong answers."

Let me finish by acknowledging that at this point you are no doubt wondering where I stand on the future path of economic growth. I will outline this in the coming days (it's time for me to get to class). Before doing that, I need to apply the information in these last two posts to what is occurring in Rhode Island. Stay tuned!

A blog devoted to providing my perspectives on the Rhode Island economy that utilizes discussion, tables, graphs, and hyperlinks to illustrate key points and where I come a lot closer to saying what I really think than what I say to the general media. A DISCLAIMER: Everything in and on this Blog is solely attributable to me and bears no connection whatever to either the University of Rhode Island overall or the URI economics department.

Wednesday, September 22, 2010

Monday, September 20, 2010

The US Recession is Officially Over

Today, the group officially responsible for applying dates to national business cycle turning points (i.e., recessions and recoveries), the National Bureau of Economic Research (NBER), declared that the most recent recession ended in June of 2009. Read their full statement.

Just as most people didn't realize we were in recession for quite some time after the most recent recession began, many didn't realize that we have now been in an economic recovery for over a year. There are several reasons for this.

First, a (national) recession is not defined the way most people think it is. Apparently almost everyone believes that a recession occurs when the US economy experiences at least two consecutive quarters where real (inflation-adjusted) GDP declines. This definition is predicated entirely on the behavior of a single variable -- national output, which would be declining for at least six consecutive months. Were this the definition, it would be very easy to "date" recessions: count to two after checking GDP releases, looking for negative growth rates. Second, the NBER does not do things this way, nor do they restrict their analysis exclusively to quarterly data. Read the Q&A about the way they define recessions and recoveries. In this, the NBER states a very important point: a recession isn't defined as being a period of low activity, but a time period of continually declining economic activity. Extending this to recoveries, these don't necessarily indicate a return to "normal" times. Instead, they reflect continually improving economic activity in a number of areas.

What is the actual definition the NBER uses to define a recession? According to the NBER, a recession is defined in the following way:

"The NBER does not define a recession in terms of two consecutive quarters of decline in real GDP. Rather, a recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales."

So, from this, what we can infer is that as we are now about a year into a national economic recovery, economic activity in a number of areas is improving (on average). THIS DOES NOT MEAN WE HAVE RETURNED TO "TRADITIONAL" LEVELS OF THESE VARIABLES. That could take months or even years, especially as our economy is in a period where persons are saving and paying down debt, and bank lending is not as great as we would like to see it.

Confusion surrounding the dates of recessions and recoveries is the manifestation of a very basic observation I will make: persons instinctively focus on the levels of economic variables; economists extend this focus on levels to rates of change as well. So, the rate of economic growth is just that -- a rate of growth and thus a measure of rate of change. Actually, economists often go farther, as we are now concerned about whether the rate of economic growth will be slowing. This means economists are now focusing on rates of change (are we slowing?) in the rate of change (the rate of economic growth). You will often hear this referred to as the "second derivative" of economic activity. Clearly, economists think and speak a different language than do most people, often defying "intuition."

Just as most people didn't realize we were in recession for quite some time after the most recent recession began, many didn't realize that we have now been in an economic recovery for over a year. There are several reasons for this.

First, a (national) recession is not defined the way most people think it is. Apparently almost everyone believes that a recession occurs when the US economy experiences at least two consecutive quarters where real (inflation-adjusted) GDP declines. This definition is predicated entirely on the behavior of a single variable -- national output, which would be declining for at least six consecutive months. Were this the definition, it would be very easy to "date" recessions: count to two after checking GDP releases, looking for negative growth rates. Second, the NBER does not do things this way, nor do they restrict their analysis exclusively to quarterly data. Read the Q&A about the way they define recessions and recoveries. In this, the NBER states a very important point: a recession isn't defined as being a period of low activity, but a time period of continually declining economic activity. Extending this to recoveries, these don't necessarily indicate a return to "normal" times. Instead, they reflect continually improving economic activity in a number of areas.

What is the actual definition the NBER uses to define a recession? According to the NBER, a recession is defined in the following way:

"The NBER does not define a recession in terms of two consecutive quarters of decline in real GDP. Rather, a recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales."

So, from this, what we can infer is that as we are now about a year into a national economic recovery, economic activity in a number of areas is improving (on average). THIS DOES NOT MEAN WE HAVE RETURNED TO "TRADITIONAL" LEVELS OF THESE VARIABLES. That could take months or even years, especially as our economy is in a period where persons are saving and paying down debt, and bank lending is not as great as we would like to see it.

Confusion surrounding the dates of recessions and recoveries is the manifestation of a very basic observation I will make: persons instinctively focus on the levels of economic variables; economists extend this focus on levels to rates of change as well. So, the rate of economic growth is just that -- a rate of growth and thus a measure of rate of change. Actually, economists often go farther, as we are now concerned about whether the rate of economic growth will be slowing. This means economists are now focusing on rates of change (are we slowing?) in the rate of change (the rate of economic growth). You will often hear this referred to as the "second derivative" of economic activity. Clearly, economists think and speak a different language than do most people, often defying "intuition."

Sunday, September 19, 2010

Welcome to this Blog!

This is the first of what promises to be many posts to this newly created blog that will detail my views about economics and the Rhode Island economy using the tools of the internet. Unlike what I have been able to provide to the local newspapers over the years, this blog will include graphs, tables, videos, and other media-relevant tools that will allow me to communicate in a far more visual way than I could ever do in newspaper articles. Those who have come to my presentations over the years will already be familiar with the types of tables and graphs I will provide here. But, unlike what I am able to say to the local media, I will come far closer to stating what I really think in this Blog. The stakes now are far too high for us to sustain the way things are being done here.

Through time, I will publish articles that what I would have submitted as Op-Ed pieces to local newspapers in this blog. At times, posts might consist only of questions that need to be discussed and answered by others in this state. Let me state that I fully intend to provide realistic analyses of where Rhode Island's economy is and where it is headed, as I have done for years.

To a number of our state's "leaders" over the years, my efforts to do this have always been viewed as "being negative." But if we don't critically and honestly evaluate both the strengths and weaknesses of our state's economy, how can we realistically expect to make it better and stronger, able to move forward competitively? We didn't do this over the last decade, especially when we finally got back on our feet in the late 1990s when we had a clear window of opportunity (see my article from 1999 and the report card I proposed that our legislators use). The result was that we were "flat footed" during the worst recession this state has faced since 1991!

It is reasonable to ascertain that the persons who have labelled me as being negative are the image of what this state defines as being "positive." If impeding efforts to make this state more competitive in the future when we had a chance to do so, then abandoning the people of this state during its worst economic crisis in twenty years is Rhode Island's definition of "positive," then please do label me as "negative."

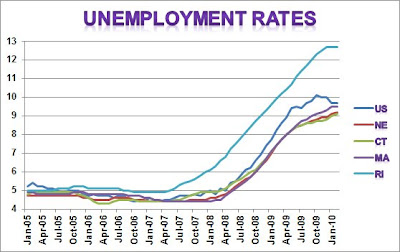

Consistent with using internet tools, let me present two graphs that scared the hell out of me from the moment I first created them (click to enlarge them). I knew things had been very bad here, but never this comparatively bad. I generated these while writing an article about Rhode Island's high unemployment rate for a Boston Federal Reserve Publication. If I had to name these, the first would be CAUSE, the second EFFECT.

I hope you are as mad and upset about what these graphs show as I am. They get my vote as being a functional definition of a state that is an economic "basket case." Remember, it never had to be this bad here. The failure of collective economic leadership in this state over the last decade is what made Rhode Island so vulnerable to national and global economic weakness. Existing structural problems, the manifestations of which are listed below, allowed our state to move from its usual doldrums into "afterburners." Consider the following "stylized facts:"

Let me end my first blog post with the way I view the "positive" people among those who run our state. Anyone currently in office who says that you should always view the glass as being half full is expendable. Any non-incumbent who utters this should be considered irrelevant.

Through time, I will publish articles that what I would have submitted as Op-Ed pieces to local newspapers in this blog. At times, posts might consist only of questions that need to be discussed and answered by others in this state. Let me state that I fully intend to provide realistic analyses of where Rhode Island's economy is and where it is headed, as I have done for years.

To a number of our state's "leaders" over the years, my efforts to do this have always been viewed as "being negative." But if we don't critically and honestly evaluate both the strengths and weaknesses of our state's economy, how can we realistically expect to make it better and stronger, able to move forward competitively? We didn't do this over the last decade, especially when we finally got back on our feet in the late 1990s when we had a clear window of opportunity (see my article from 1999 and the report card I proposed that our legislators use). The result was that we were "flat footed" during the worst recession this state has faced since 1991!

It is reasonable to ascertain that the persons who have labelled me as being negative are the image of what this state defines as being "positive." If impeding efforts to make this state more competitive in the future when we had a chance to do so, then abandoning the people of this state during its worst economic crisis in twenty years is Rhode Island's definition of "positive," then please do label me as "negative."

Consistent with using internet tools, let me present two graphs that scared the hell out of me from the moment I first created them (click to enlarge them). I knew things had been very bad here, but never this comparatively bad. I generated these while writing an article about Rhode Island's high unemployment rate for a Boston Federal Reserve Publication. If I had to name these, the first would be CAUSE, the second EFFECT.

I hope you are as mad and upset about what these graphs show as I am. They get my vote as being a functional definition of a state that is an economic "basket case." Remember, it never had to be this bad here. The failure of collective economic leadership in this state over the last decade is what made Rhode Island so vulnerable to national and global economic weakness. Existing structural problems, the manifestations of which are listed below, allowed our state to move from its usual doldrums into "afterburners." Consider the following "stylized facts:"

- Rhode Island was one of the first states to experience persistent budget deficits;

- Rhode Island's employment peaked in January of 2007, almost a year before the national employment peak;

- Rhode Island's economy went into recession in June of 2007 (based on my Current Conditions Index), six months before the US recession began; and

- Rhode Island was losing population consistently since July of 2004 when it moved into recession.

Let me end my first blog post with the way I view the "positive" people among those who run our state. Anyone currently in office who says that you should always view the glass as being half full is expendable. Any non-incumbent who utters this should be considered irrelevant.

Subscribe to:

Comments (Atom)